All Categories

Featured

Table of Contents

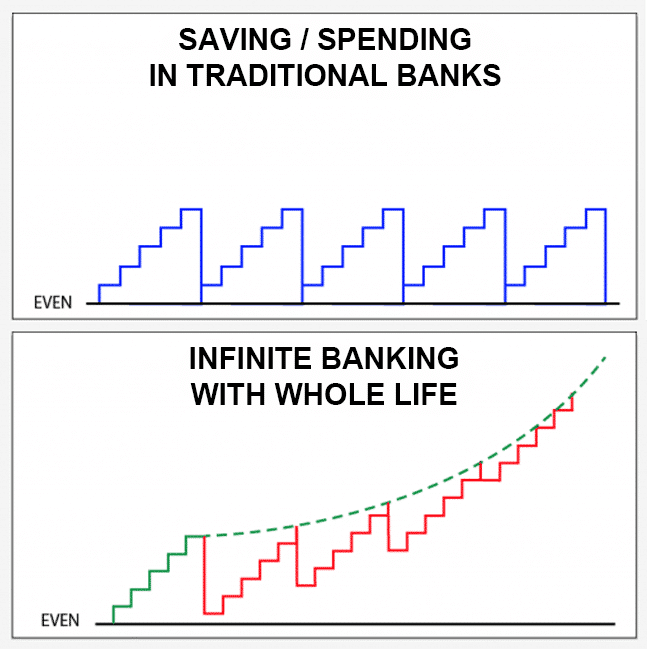

For the majority of people, the greatest issue with the boundless banking principle is that first hit to very early liquidity created by the expenses. This disadvantage of unlimited financial can be reduced considerably with proper policy design, the very first years will always be the worst years with any kind of Whole Life plan.

That stated, there are specific limitless financial life insurance coverage policies created mostly for high early cash money worth (HECV) of over 90% in the first year. However, the long-lasting efficiency will certainly commonly significantly delay the best-performing Infinite Financial life insurance policy plans. Having access to that additional four figures in the first couple of years may come at the expense of 6-figures in the future.

You really get some significant long-lasting advantages that assist you recover these very early expenses and after that some. We locate that this hindered very early liquidity trouble with infinite banking is a lot more mental than anything else once thoroughly discovered. In reality, if they absolutely required every cent of the cash missing from their limitless financial life insurance policy in the first couple of years.

Tag: unlimited financial idea In this episode, I chat regarding financial resources with Mary Jo Irmen that teaches the Infinite Banking Idea. This topic may be questionable, however I intend to get varied sights on the show and learn more about different strategies for ranch economic monitoring. A few of you may concur and others will not, but Mary Jo brings an actually... With the rise of TikTok as an information-sharing platform, economic advice and techniques have located an unique method of dispersing. One such method that has actually been making the rounds is the infinite banking idea, or IBC for short, amassing recommendations from celebrities like rap artist Waka Flocka Fire. While the approach is presently preferred, its origins trace back to the 1980s when financial expert Nelson Nash presented it to the world.

Within these policies, the money value expands based on a price established by the insurance firm. When a significant money worth accumulates, policyholders can acquire a cash money value financing. These lendings vary from conventional ones, with life insurance policy acting as collateral, indicating one could lose their coverage if borrowing exceedingly without sufficient money worth to support the insurance costs.

And while the attraction of these policies appears, there are inherent constraints and dangers, demanding thorough cash money worth tracking. The strategy's legitimacy isn't black and white. For high-net-worth people or company owner, especially those making use of methods like company-owned life insurance policy (COLI), the advantages of tax breaks and substance development can be appealing.

Ibc Full Form In Banking

The attraction of limitless financial doesn't negate its challenges: Expense: The fundamental demand, a long-term life insurance policy plan, is more expensive than its term counterparts. Qualification: Not every person certifies for whole life insurance policy as a result of extensive underwriting procedures that can exclude those with specific wellness or lifestyle conditions. Intricacy and risk: The detailed nature of IBC, coupled with its threats, may deter many, particularly when less complex and less dangerous choices are available.

Allocating around 10% of your monthly revenue to the plan is just not practical for many people. Making use of life insurance as an investment and liquidity source needs self-control and monitoring of policy money worth. Get in touch with an economic expert to establish if infinite financial lines up with your concerns. Component of what you check out below is just a reiteration of what has actually currently been stated over.

Prior to you get yourself into a situation you're not prepared for, know the following initially: Although the principle is generally marketed as such, you're not in fact taking a financing from yourself. If that were the situation, you would not have to repay it. Instead, you're obtaining from the insurer and need to repay it with rate of interest.

Some social media messages advise using money value from entire life insurance policy to pay for charge card financial debt. The concept is that when you settle the car loan with interest, the quantity will certainly be returned to your investments. That's not how it works. When you pay back the finance, a portion of that rate of interest mosts likely to the insurance provider.

For the first a number of years, you'll be repaying the compensation. This makes it exceptionally hard for your policy to accumulate value throughout this time. Whole life insurance expenses 5 to 15 times a lot more than term insurance. The majority of people simply can't manage it. Unless you can manage to pay a couple of to numerous hundred bucks for the following decade or even more, IBC won't function for you.

Infinite Banking Powerpoint Presentations

Not every person should rely exclusively on themselves for monetary protection. If you call for life insurance policy, right here are some useful ideas to think about: Consider term life insurance coverage. These policies give insurance coverage throughout years with substantial monetary obligations, like mortgages, pupil fundings, or when taking care of young kids. Make certain to shop around for the very best rate.

Copyright (c) 2023, Intercom, Inc. () with Booked Typeface Name "Montserrat". This Typeface Software application is certified under the SIL Open Typeface License, Version 1.1. Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Scheduled Typeface Call "Montserrat". This Font style Software application is certified under the SIL Open Up Typeface License, Version 1.1.Skip to main web content

Banker Life Quotes

As a certified public accountant focusing on real estate investing, I've brushed shoulders with the "Infinite Financial Principle" (IBC) much more times than I can count. I have actually even interviewed specialists on the topic. The major draw, in addition to the obvious life insurance policy advantages, was always the concept of accumulating cash value within a permanent life insurance coverage plan and loaning against it.

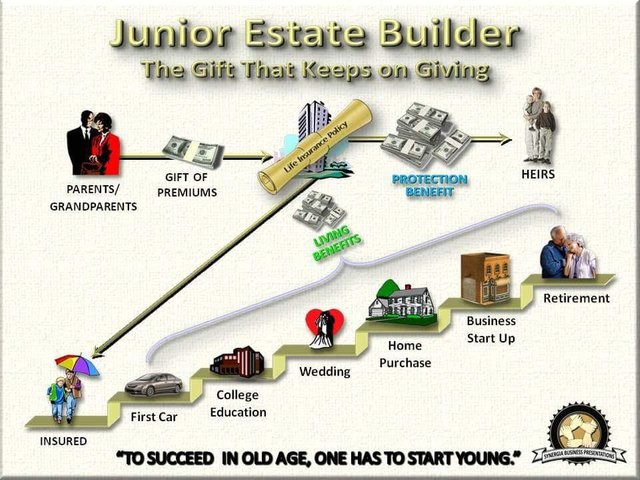

Sure, that makes sense. Honestly, I constantly thought that money would be better spent directly on financial investments instead than channeling it with a life insurance policy Up until I uncovered exactly how IBC can be combined with an Irrevocable Life Insurance Count On (ILIT) to create generational riches. Allow's begin with the essentials.

Using A Life Insurance Policy As A Bank

When you borrow against your policy's cash money worth, there's no set repayment schedule, offering you the freedom to handle the finance on your terms. On the other hand, the cash money value remains to grow based on the plan's guarantees and returns. This arrangement permits you to accessibility liquidity without disrupting the long-lasting growth of your plan, offered that the funding and interest are managed wisely.

As grandchildren are birthed and grow up, the ILIT can purchase life insurance policy plans on their lives. Family members can take finances from the ILIT, making use of the cash worth of the policies to fund investments, start organizations, or cover significant expenditures.

A critical facet of managing this Family Bank is using the HEMS requirement, which stands for "Health, Education And Learning, Upkeep, or Assistance." This standard is usually consisted of in trust contracts to guide the trustee on just how they can distribute funds to recipients. By adhering to the HEMS requirement, the count on makes certain that circulations are made for vital requirements and lasting assistance, safeguarding the trust fund's properties while still offering family members.

Increased Adaptability: Unlike rigid bank finances, you manage the payment terms when borrowing from your own plan. This enables you to structure payments in a manner that lines up with your business cash circulation. does infinite banking work. Enhanced Capital: By funding business expenses with plan lendings, you can potentially maximize cash money that would certainly otherwise be tied up in traditional funding payments or tools leases

He has the same tools, yet has actually likewise built added cash money value in his policy and obtained tax benefits. And also, he now has $50,000 available in his plan to utilize for future opportunities or costs. In spite of its potential advantages, some individuals continue to be doubtful of the Infinite Banking Concept. Allow's attend to a couple of usual issues: "Isn't this simply expensive life insurance policy?" While it's real that the premiums for an appropriately structured entire life plan might be greater than term insurance, it's important to watch it as greater than just life insurance coverage.

Whole Life Infinite Banking

It has to do with developing a flexible financing system that gives you control and gives numerous benefits. When utilized strategically, it can match other investments and service strategies. If you're intrigued by the potential of the Infinite Financial Idea for your organization, here are some actions to think about: Inform Yourself: Dive deeper right into the concept via respectable books, seminars, or examinations with well-informed professionals.

Latest Posts

Infinite Banking Insurance

Infinite Banking Scam

Become Your Own Bank Today! It's A Strategy That Many Have ...